ending work in process inventory calculation

In this formula your beginning inventory is the dollar amount of product the company has at the onset of the accounting period. WIP b beginning work in process.

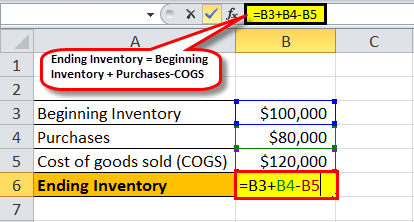

Ending Inventory Formula Step By Step Calculation Examples

The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity.

. During the year 150000 is spent on manufacturing costs along with your total cost of finished goods being 205000. As determined by previous accounting records your companys beginning WIP is 115000. When you are ready to calculate work in process inventory you must calculate it based off of the cost of production to the point where of the processes had first come to a halt.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. What is the difference between work in process and work in progress inventory. Consider that it was 35000.

Here are the steps for using the gross profit method of calculating ending inventory. Furthermore what is the cost of the ending work in process inventory. C m cost of manufacturing.

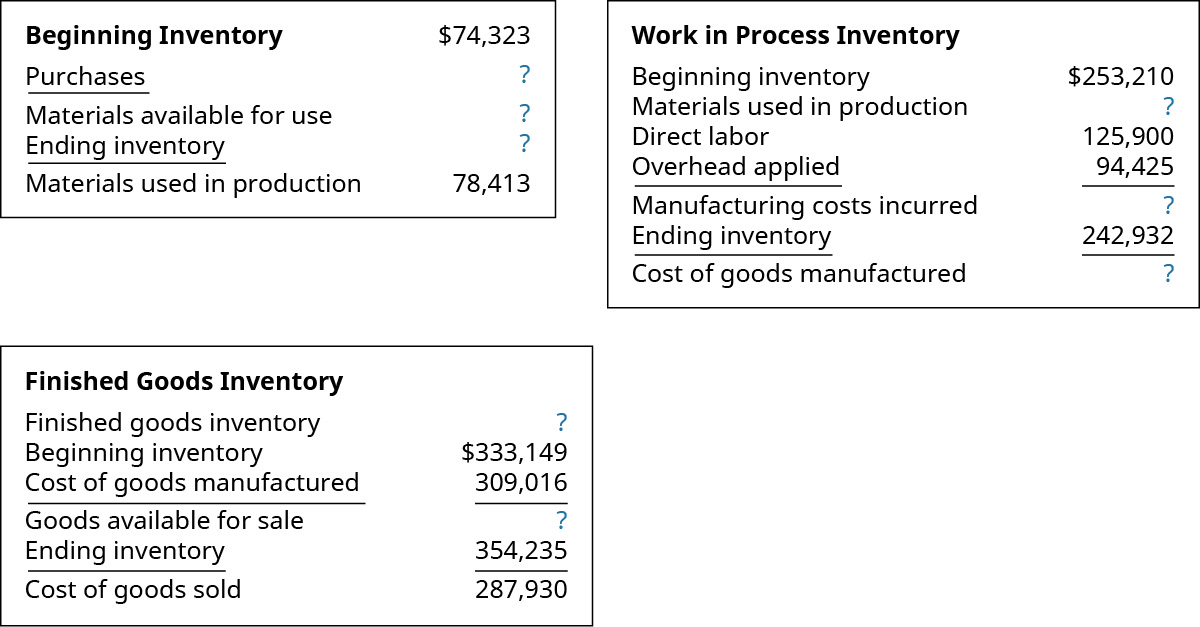

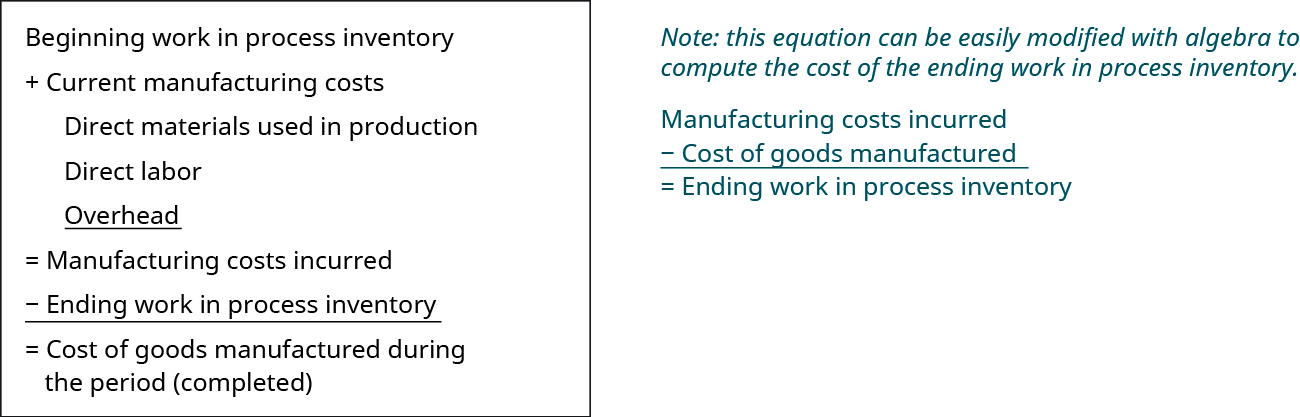

The last quarters ending work in process. The formula for ending work in process is relatively simple. The calculation of ending work in process is.

Find the cost of goods available. How do you calculate ending inventory units. Ending Inventory Beginning Inventory Purchases -Cost of Goods Sold COGS.

Work in process WIP is inventory that has been partially completed but which requires additional processing before it can be classified as finished goods inventory. Heres how it looks. Calculating Your Work-In-Process Inventory.

The ending Inventory formula calculates the value of goods available for sale at the end of the accounting period. Work In-process Inventory Example. In this formula your beginning inventory is the dollar amount of product the company has at the onset of the accounting period.

C m cost of manufacturing. We can say it was 45000. You can do this by adding the cost of your beginning inventory with the cost of all purchases.

WIP b beginning work in process. In this equation WIP e ending work in process. The result is the.

WIP e WIP b C m - C c. Multiply 1 expected gross profit by sales during the period to arrive at the estimated cost of goods sold. You can now input these values to the formula.

Usually it is recorded on the balance sheet at a lower cost or its market value. Here is the basic formula you can use to calculate a companys ending inventory. The calculation of ending work in process.

What is the formula to calculate ending inventory. Add total WIP costs 4109350. Most businesses that are not run by experienced operations management experts will have too much work in process.

Beginning inventory net purchases - COGS ending inventory. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods. Find the ending.

From there you would calculate ending WIP inventory amount. Thus your ending WIP inventory comes out to be 100000 for the year. 100000 150000 150000 100000.

It is important to note that the methods of calculating ending inventory can only be used for estimating the inventory. Beginning inventory net purchases COGS ending inventory. Therefore many companies only calculate work in process inventory close to the end of a specific reporting period to minimize time spent on calculations.

The calculation to find the work-in-progress inventory at the end of the year is as follows. Assume Company A manufactures perfume. Determine the cost of manufacturing the goods you sold over this particular month.

Additional Business Financial. And C c cost of goods completed. Subtract the estimated cost of goods sold step 2 from the cost of goods available for sale step 1 to arrive at the ending inventory.

WIP Inventory Example 2. This ending inventory figure is listed as a current asset on a balance sheet. Subtract cost of finished buses 4403350.

Therefore the formula to calculate the Work in Process WIP is. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Calculating work in process inventory is a complicated and time consuming process because it requires an assessment of the percentage of work completed and the cost associated with it.

Formula to Calculate Ending Inventory. And C c cost of goods completed. To calculate your in-process inventory the following WIP inventory formula is followed.

The net purchases are the items youve bought and added to your inventory count. Calculating how much it will cost to produce the unfinished products is also necessary. To calculate WIP inventory you need the beginning work in process inventory and to calculate that you need the ending work in process inventory.

Furthermore you must calculate the value of the materials as well. Beginning inventory net purchases COGS ending inventory. Global Tech News Daily.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory. Ending WIP Inventory Beginning WIP Inventory Production Costs Finished Goods Cost.

How to Calculate Ending Work In Process Inventory The work in process formula is. The basic formula for calculating ending inventory is. Ignoring work in process calculations entirely.

Formulas to Calculate Work in Process. CIQA is a quality and regulatory consultant with 25 years of experience developing products and managing projects in the medical device supply chain and pharmaceutical industries. Beginning work-in-progress inventory 2856000.

How to Calculate Work in Process Inventory. Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods.

Here is the basic formula you can use to calculate a companys ending inventory. How to calculate ending inventory Estimate the net worth of purchases made during the month. A physical count or a cycle counting program is needed for an accurate ending inventory valuation.

Find the cost of goods sold. Your beginning inventory is the last periods ending inventory. In this equation WIP e ending work in process.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. The cost of goods sold includes the total cost of purchasing inventory.

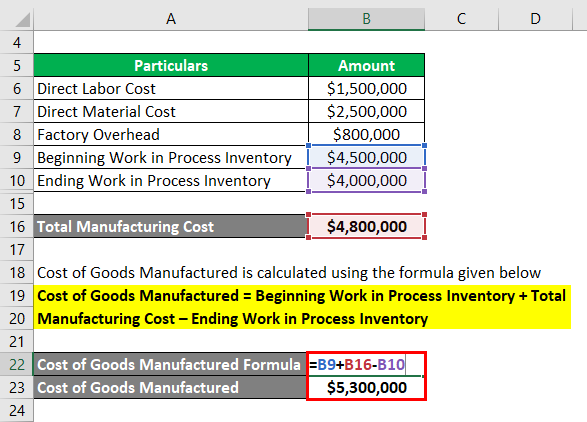

Cost Of Goods Manufactured Cogm How To Calculate Cogm

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Wip Inventory Definition Examples Of Work In Progress Inventory

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing Account Format Double Entry Bookkeeping

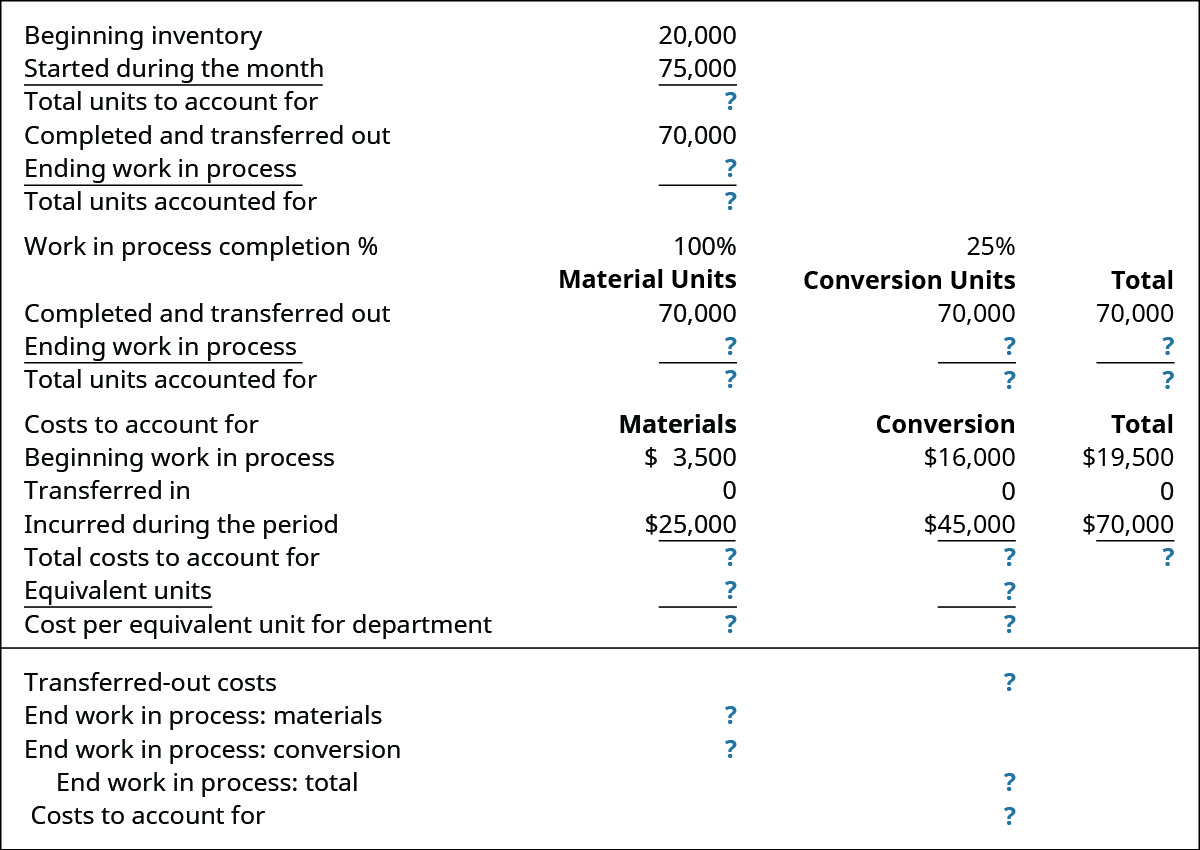

Explain And Compute Equivalent Units And Total Cost Of Production In A Subsequent Processing Stage Principles Of Accounting Volume 2 Managerial Accounting

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

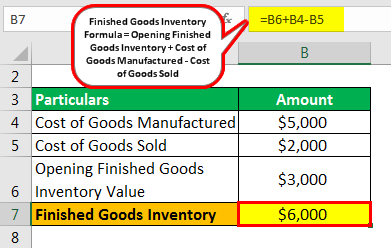

Finished Goods Inventory How To Calculate Finished Goods Inventory

Ending Inventory Formula Step By Step Calculation Examples

Inventory Formula Inventory Calculator Excel Template

Work In Process Wip Inventory Youtube

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

What Is Work In Process Wip Inventory How To Calculate It Ware2go